In the last two editions of IFSWF Direct and our recent report, Building Resilience: Long-Term Investors Respond to Inflation Moderation, we have documented that sovereign wealth funds and other long-term investors face a new investment environment in which non-financial risks, such as geoeconomic fragmentation, climate change and increasing inequality, are becoming more important in their investment decisions and how they allocate their capital. In this new environment, which has arisen since the COVID-19 pandemic, correlations between traditionally diversifying asset classes have risen, leaving these long-term investors asking themselves, “Is traditional asset allocation broken?”

In the decade and a half after the Global Financial Crisis, sovereign wealth funds increased their risk appetite and, consequently, their allocations to private markets to meet their return targets and to uphold their fiduciary duty to invest for the benefit of future generations amid “lower for longer” interest rates and inflation. As recently as 2021, our research showed that many IFSWF members were increasing their allocations to growth and venture capital, both through direct investments and as limited partners in funds.

However, in 2022 and 2023, we have observed a cooling of sovereign wealth funds’ sentiment on venture and growth investments. This trend is set against a general malaise of investor sentiment in this sector, the so-called “Venture Capital Winter.” In 2023, there was a marked decline in direct investments by sovereign wealth funds in startups, with only 31 participations in venture equity raises, compared to 97 deals in 2022 and 133 in 2021.

“Globally, the investment activity of the venture and growth equity asset class slowed down materially”, explained Douraid Zaghouani, Chief Operating Officer at Investment Corporation of Dubai (ICD), in an exclusive interview with IFSWF. “As many firms had to prioritise liquidity management and business model efficiency,” continued Zaghouani.

Douraid Zaghouani, Chief Operating Officer at Investment Corporation on the current venture capital environment.

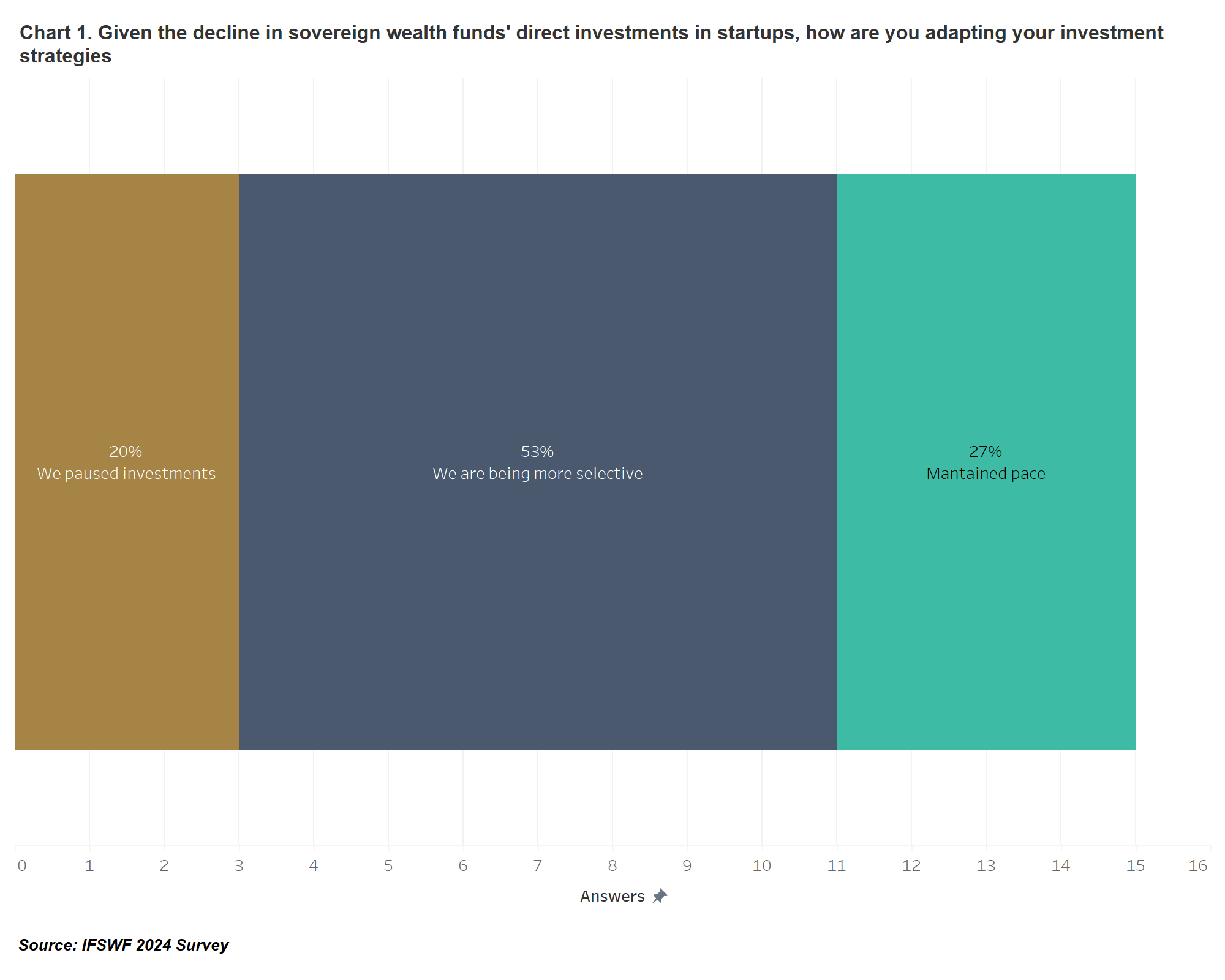

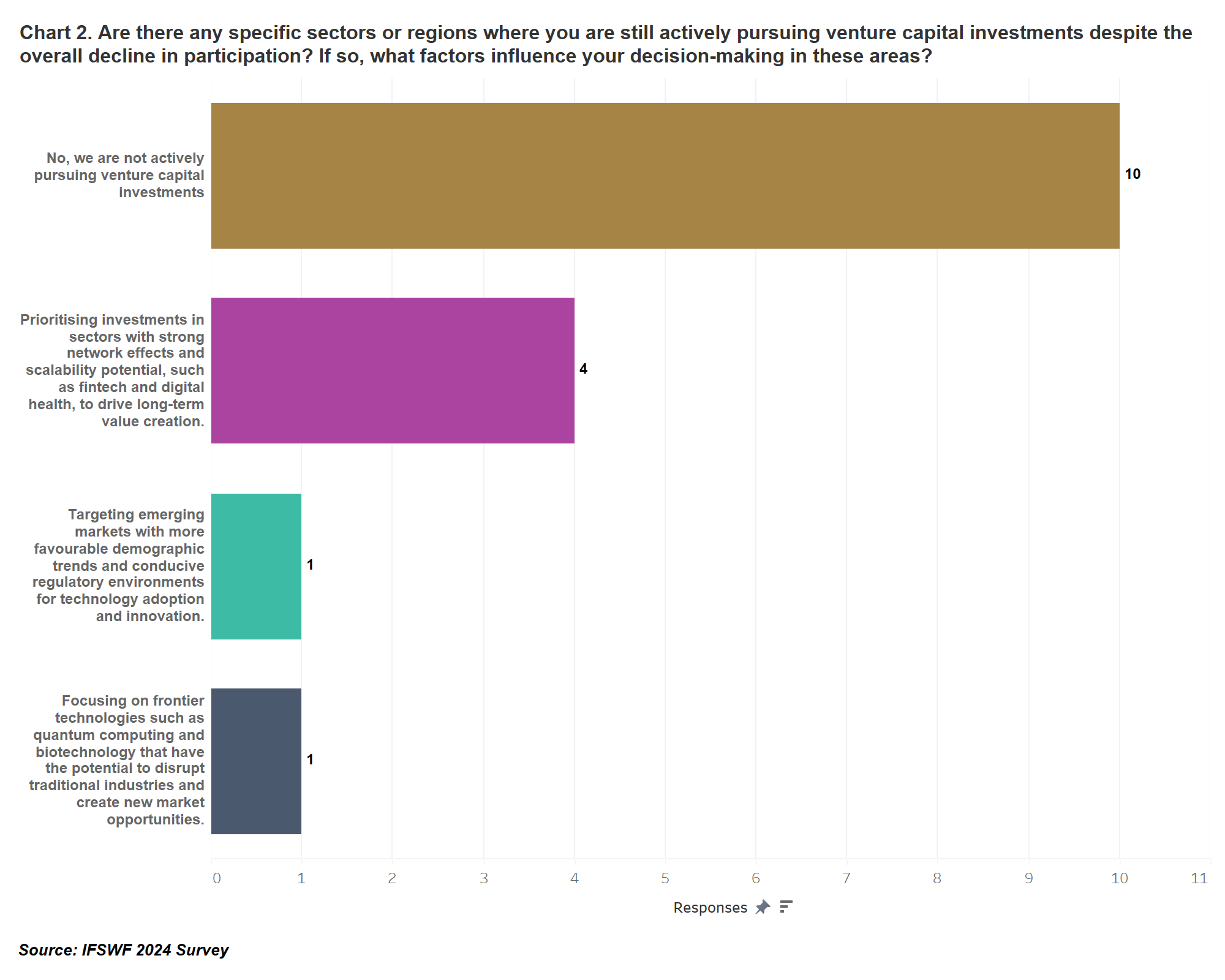

To support our data, we surveyed IFSWF members and received 16 responses. The survey results align with our direct investment data, with three-quarters of respondents stating they were more cautious about investing in startups, with 20% halting investments altogether. At the same time, 63% of respondents answered that they were not actively pursuing any venture capital investments.

In our latest report with State Street, we highlighted how long-term investors and sovereign wealth funds have managed their capital flows and portfolio reallocations in response to changing market conditions. Our recent survey supports these findings, revealing that over 60% of respondents indicated that sovereign wealth funds have maintained their investment strategies and portfolio compositions.

As sovereign wealth funds adapt to shifting market dynamics and geopolitical uncertainties, they have primarily focused on making strategic investments in tangible assets and emerging sectors to promote long-term sustainability and economic resilience.

Essentially, sovereign wealth funds' adaptability and strategic understanding of an investment environment characterised by inflation rates not seen in nearly 20 years underscore their resilience and ability to thrive in challenging environments, positioning them to capture opportunities and drive sustainable growth in the years ahead.

We will explore this further in our IFSWF Annual Review 2023, Inflation Proofing: Sovereign Wealth Funds Buy Tangible Assets, which will feature an exclusive interview with Douraid Zaghouani, COO of one of IFSWF’s newest members, ICD.